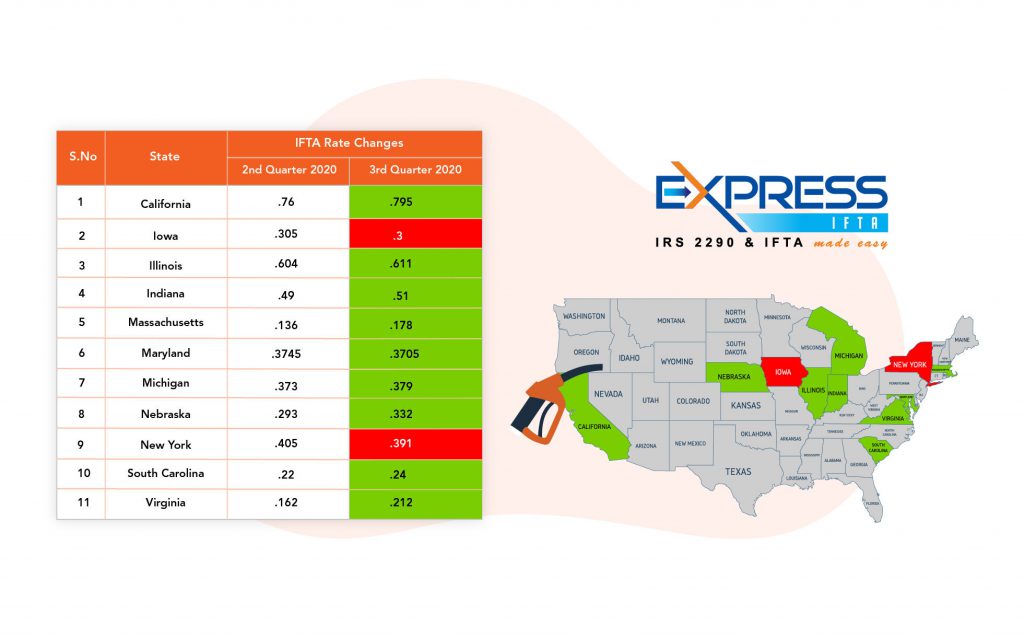

3rd Quarter IFTA Rate Changes You Need To Know About

Nearly every quarter, member jurisdictions of the International Fuel Tax Association Inc. change their fuel tax rates.

The 3rd quarter of 2020 is no exception. Several IFTA jurisdictions have changed their tax rates. Here’s what you need to know.

What are the rate changes?

| S.No. | State | Fuel Type | IFTA Rate Changes | |

| 2nd Quarter 2020 | 3rd Quarter 2020 | |||

| 1. | California | Diesel | .76 | .795 |

| 2. | Iowa | Gasoline | .305 | .3 |

| Gasohol | .29 | .3 | ||

| Ethanol | .29 | .24 | ||

| Methanol | .305 | .3 | ||

| E85 | .29 | .24 | ||

| M85 | .305 | .3 | ||

| A55 | .305 | .3 | ||

| Biodiesel | .295 | .301 | ||

| 3. | Illinois | Diesel | .604 | .611 |

| Gasoline | .524 | .531 | ||

| Gasohol | .524 | .531 | ||

| Propane | .6 | .607 | ||

| Liquid natural gas | .604 | .611 | ||

| Compressed natural gas | .483 | .49 | ||

| Ethanol | .524 | .531 | ||

| Methanol | .524 | .531 | ||

| E85 | .524 | .531 | ||

| M85 | .524 | .531 | ||

| A55 | .524 | .531 | ||

| Biodiesel | .604 | 611 | ||

| 4. | Indiana | Diesel | .49 | .51 |

| Gasoline | .3 | .31 | ||

| Gasohol | .3 | .31 | ||

| Propane | .49 | .51 | ||

| Liquid natural gas | .49 | .51 | ||

| Compressed natural gas | .49 | .51 | ||

| Ethanol | .3 | .31 | ||

| Methanol | .3 | .31 | ||

| E85 | .3 | .31 | ||

| M85 | .3 | .31 | ||

| A55 | .3 | .31 | ||

| Biodiesel | .49 | .51 | ||

| 5. | Massachusetts | Propane | .136 | .178 |

| Liquid Natural Gas | .136 | .178 | ||

| Compressed Natural Gas | .136 | .178 | ||

| 6. | Maryland | Diesel | .3745 | .3705 |

| Gasoline | .367 | .363 | ||

| Gasohol | .367 | .363 | ||

| Propane | .367 | .363 | ||

| Liquid natural gas | .367 | .363 | ||

| Compressed natural gas | .367 | .363 | ||

| Ethanol | .367 | .363 | ||

| Methanol | .367 | .363 | ||

| E85 | .367 | .363 | ||

| M85 | .367 | .363 | ||

| A55 | .3745 | .3705 | ||

| Biodiesel | .3745 | .3705 | ||

| 7. | Michigan | Diesel | .373 | .379 |

| Gasoline | .338 | .371 | ||

| Gasohol | .338 | .371 | ||

| Propane | .373 | .379 | ||

| Liquid natural gas | .373 | .379 | ||

| Compressed natural gas | .338 | .371 | ||

| Ethanol | .338 | .371 | ||

| Methanol | .338 | .371 | ||

| E85 | .338 | .371 | ||

| M85 | .338 | .371 | ||

| A55 | .373 | .379 | ||

| Biodiesel | .373 | .379 | ||

| Hydrogen | .373 | .379 | ||

| 8. | Nebraska | Diesel | .293 | .332 |

| Gasoline | .293 | .332 | ||

| Gasohol | .293 | .332 | ||

| Propane | .293 | .332 | ||

| Liquid natural gas | .293 | .332 | ||

| Compressed natural gas | .293 | .332 | ||

| Ethanol | .293 | .332 | ||

| Methanol | .293 | .332 | ||

| E85 | .293 | .332 | ||

| M85 | .293 | .332 | ||

| A55 | .293 | .332 | ||

| Biodiesel | .293 | .332 | ||

| 9. | New York | Gasoline | .405 | .391 |

| Gasohol | .231 | .217 | ||

| Propane | .405 | .391 | ||

| Ethanol | .405 | .391 | ||

| Methanol | .405 | .391 | ||

| M85 | .405 | .391 | ||

| A55 | .405 | .391 | ||

| 10. | South Carolina | Diesel | .22 | .24 |

| Gasoline | .22 | .24 | ||

| Gasohol | .22 | .24 | ||

| Propane | .22 | .24 | ||

| Liquid natural gas | .22 | .24 | ||

| Compressed natural gas | .22 | .24 | ||

| Ethanol | .22 | .24 | ||

| Methanol | .22 | .24 | ||

| 11. | Virginia | Gasoline | .162 | .212 |

| Gasohol | .162 | .212 | ||

| Propane | .162 | .212 | ||

| Liquid natural gas | .183 | .239 | ||

| Compressed natural gas | .162 | .212 | ||

| Ethanol | .162 | .212 | ||

| Methanol | .162 | .212 | ||

| E85 | .162 | .212 | ||

| M85 | .162 | .212 | ||

| A55 | .162 | .212 | ||

When are my IFTA taxes due?

3rd quarter IFTA tax reports are due on November 2, 2020. You need to generate your IFTA report, calculate your tax owed, and make your payment before the deadline.

Why Use ExpressIFTA?

The easiest way to keep up with all the IFTA rate changes and to generate your report on time is to use ExpressIFTA.

Our system is automatically updated with the latest IFTA rate changes every quarter, so you can always be sure your report is accurate.

All you need to do is enter all your mileage and fuel information and ExpressIFTA will generate a report or worksheet that you can use to file with your base jurisdiction.

You can also bulk upload information from spreadsheets or GPS units for faster reporting.

4,055 total views, 1 views today