Your 3rd Quarter IFTA Deadline is Next Week!

Despite the continuing surge of Coronavirus cases and the end of many relief packages looming, the 3rd quarter IFTA deadline has not been delayed for most jurisdictions.

That means you need to report and file all your mileage and fuel purchase information from July 1 – September 30 by November 2!

Why you need to file an IFTA report

IFTA filing is required by law for all qualified motor vehicles that traveled between two or more jurisdictions! Failing to file on time can lead to serious penalties and even the removal of your IFTA license.

Even if you didn’t drive your truck at all this quarter, you still need to file an IFTA report. This is so that your base jurisdiction is aware of your activity and does not hit you with penalties for failing to file.

Generate a report with ExpressIFTA

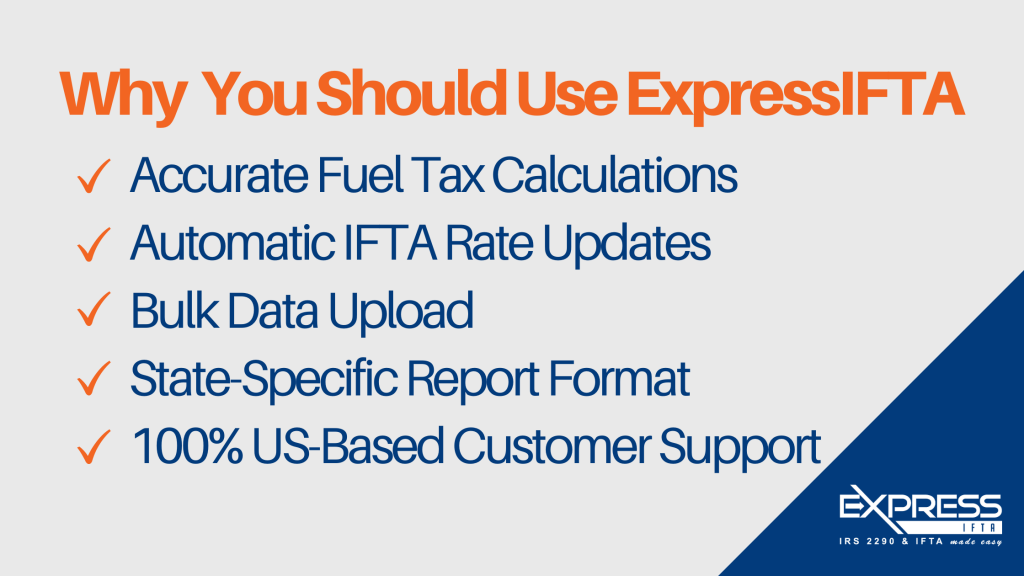

When it comes to IFTA reporting, there’s no easier way to generate your report than with ExpressIFTA. Simply input your business information, mileage, and fuel purchases and our software will output an IFTA report in a format appropriate for filing with your base jurisdiction.

IFTA data can be added manually, imported from your GPS, or uploaded in bulk and always undergoes an instant audit to check for common errors. Plus our software is always updated with the latest tax rate and exemption information, so you can rest assured that your fuel tax amount will be calculated accurately.

And as always, if you have any questions, you can call our 100% US-based customer support team at (704) 234-6005!

1,770 total views, 1 views today